Counterintuitive effects of minimum prices

they lower utilization

The Attorney General of Massachusetts recently announced that drivers for ride-sharing companies must be paid at least $32.50 per hour.

Now, if you’re a hardcore libertarian, then you probably hate the minimum wage. You already disagree with this policy, so you need no convincing and we can part now on good terms.

But what if you’re part of the vast majority of people who like the minimum wage? What if you think the minimum wage is awesome and you want to expand it? That’s fine. I won’t try to change your mind! But even so, there are strong reasons to be skeptical about this policy.

Because: If you read closely, you’ll see that Massachusetts’ rule is that drivers must be paid $32.50 for hours that they spend driving passengers around. For the time they spend waiting for passengers to request rides, they will still be paid $0. And when you screw around with prices, you change the amount of time they spend waiting around.

This kind of policy could help drivers. But if you analyze things carefully, it can’t help them very much. In the end, this policy is mostly equivalent to forcing riders to pay extra to subsidize drivers sitting around doing nothing.

I’ll first give the intuition with words and drawings, and then I’ll prove it with a tiny bit of math.

Story time

Say there’s a city—call it Billiard Ball Falls—where people behave in suspiciously convenient ways. All rides take exactly one hour, including the time for the driver to get to the rider. And demand for rides is constant over time.

Now, how many rides would you take if they only cost $1? Personally, I’d buy fresh produce and visit friends across town more often. Eventually, I might move further away from work. But if rides cost $1000, I’d only take them in emergencies. Assuming most people are like me, the total demand for rides from all people will decrease as the price goes up. Maybe something like this:

Meanwhile, if drivers were paid $1 per ride, who would drive? Maybe a tiny number of very bored and lonely people? I certainly wouldn’t. But if I could earn $1000 per ride, I’d feel morally obligated to drive and donate much of the money to charity. So the total supply of rides from all people, is some kind of upward-sloping curve:

In a free market, prices will—under some not-too-crazy assumptions—eventually settle at whatever price makes these curves intersect.

Riders pay around $2.33 per ride and drivers earn around $2.33 per hour. A story as old as ECON 101.

But we’re here to talk about something more interesting. What if the government mandates a new, higher, price?

We have a problem. Since rides now cost more than the old market price, people will buy fewer rides.

But since pay is higher, more people will want to be drivers.

That’s not going to work. Riders can’t buy 300 rides per hour while drivers are selling 500 rides per hour. That would violate conservation of ride.

Ordinarily, what would happen in this situation is prices would go down. This would cause drivers to drive a bit less and riders to ride a bit more and this would continue until the price went back to the market price. But that can’t happen when the price is fixed. So what happens instead?

Well, demand can’t change. People will want to buy some number of rides at the government price and that’s that.

In this situation, supply matches demand through a decrease in the utilization of drivers. Think of it like this: Prices are high, so lots of people want to offer rides. But there’s a shortage of customers, so drivers will have to wait around a while before they get a customer.

Now there’s a subtle point here. (One that took me quite a while to figure out.)

It’s easiest to understand with an example. Say the government mandates a price of $30 per ride and say drivers spend U=⅔ of their time actually working. Then the effective wage is $20 per hour, so people supply SUPPLY($20) hours of work. But only ⅔ of those hours actually become rides, so the number of rides supplied is ⅔ × SUPPLY($20).

Get that? When drivers spend more time waiting around, this decreases supply in two ways.

When drivers wait around, they don’t create any rides (duh).

When drivers wait around, this makes their effective wage lower, so they drive less.

If the government mandates a price of P and drivers spend a fraction U of their time waiting around, and you account for both of the above effects, the actual number of rides supplied will be U×SUPPLY(U×P). (Through the logic in the above example.)

OK, so remember where we left our example.

The supply curve SUPPLY(P) is the same as U×SUPPLY(U×P) when U is 1. What happens in this situation is that U decreases until U×SUPPLY(U×P) intersects with the demand curve at the government price. This happens to be when U is around 0.9, meaning drivers spend 90% of their time driving customers around and 10% of their time waiting around:

Now what? Now we’re done. We just have to remember that the effective wage of drivers is government price times the utilization rate. In this case that’s around 10% lower:

So, in this example, after the government increases prices:

Riders pay more.

Riders take fewer rides.

Drivers spend more time waiting around.

Driver wages don’t increase.

Now, the effective wage usually will change, at least at little. It depends on the situation.

In one extreme, people could be totally insensitive to prices. No matter how much rides costs, riders keep buying the same number of rides. And no matter how much drivers are paid, no one works more hours. In this case, forcing a higher price won’t decrease utilization—it will just transfer more money from riders to drivers.

In the other extreme, people could be very sensitive to prices. When prices go up, riders cut back on rides and drivers try to work more. In this case, forcing a higher price will decrease utilization a lot and the effective wage might even go down.

But how exactly does this work? In realistic situations, how much will a price increase actually help drivers?

I’m glad you asked!

Science time

Humans encompass multitudes. There are infinite possible supply and demand curves. This complicates things for bloggers trying to disparage Massachusetts ride-sharing price minimums.

So why don’t you just try it? Here’s a calculator. Enter whatever supply and demand curves you want, and how much the government will increase prices. It will then calculate the utilization rate and wage drivers earn at the new equilibrium. (You can use simple Javascript in your formulas, e.g. you can write W**2 for W² or Math.log(W) for log(W).)

If you screw around for a while, you will hopefully notice that it’s quite hard to increase wages much above the market wage. It is possible, but requires you to assume that people basically don’t care about prices. For example, if DEMAND(P)=101-P and SUPPLY(W)=99+W, then the market price is $1/ride. If the government increases that to $2/ride, then utilization only drops slightly to 0.981, so the effective wage goes up from $1/hr to $1.961/hr.

But is it realistic to assume that people don’t care about prices? Do you really have to assume that? Can we prove anything with “realistic” assumptions?

Math time

In this section, I’ll prove that that when the government increases prices, the absolute best that drivers can hope for is that 50% of the extra money shows up in wages. For example, if the market price is $20/ride (and the market wage $30/hr) and the government increases the price to $30/ride, then the highest possible new wage is $25/hr. And probably less.

(If you hate math and you trust me, feel free to skip this section.)

To obviate with the vastness of the human condition with its infinite supply and demand curves, I’m going to analyze a situation where the price starts at the market price and then is changed to be just slightly higher. This is helpful, because then we only need to worry about the supply and demand near the equilibrium, which reduces everything to just four numbers.

This is helpful, because it means we only need to care about the shape of the supply and demand curves near the equilibrium, which reduces things to just four numbers.

THEOREM. (Me, 2025) Suppose that W(P) is the effective wage at price P. Then at the market price P,

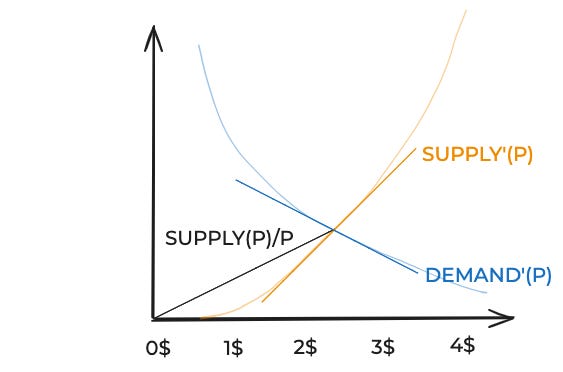

Let’s try to understand what this means. First, recall our equilibrium graph:

The three quantities in the equation can be seen as the slopes of three lines in this graph.

Specifically:

DEMAND(P)/P is the slope of the line that goes from the origin to the equilibrium point. This is the number of rides that happen per dollar at the equilibrium point.

DEMAND’(P) is the slope of the demand curve at the equilibrium point. This is how sensitive demand is to changes in price. It’s a negative number, since demand goes down when prices go up.

SUPPLY’(P) the slope of the supply curve at the equilibrium point. This is how sensitive supply is to changes in wages. This is a a positive number, since supply goes up when prices go up.

Note that the government increasing prices could cause wages to go down. This will happen if demand is sensitive enough to prices near equilibrium:

COROLLARY. The change in wages W’(P) is negative if and only if the magnitude of DEMAND’(P) (a negative number) is larger than the magnitude of SUPPLY(P)/P.

I’m not sure how likely it is that wages would actually go down in practice. When I try making up plausible-seeming supply and demand curves, wages do go down sometimes, but it’s fairly rare, and even when it happens the decrease is usually small.

Here’s a result that I think is more important in practice. Informally, it says that if the supply curve is “upward sloping”, then the increase in wages is at most 50% of the increase in prices. To me, this is the strongest argument against increasing prices.

COROLLARY. If SUPPLY’(P) > SUPPLY(P)/P, then W’(P)<½.

When will the supply curve be upward sloping? Let me be show you what I’m talking about:

If this is true, then I think we can fairly say that “most of the extra money the government is forcing people to pay doesn’t manifest as extra wages”.

I claim this is almost certainly true.

Think of it like this: If wages were half as much, would people drive half as much? Or less than half as much? I think it’s less than half as much. This means that the orange curve in the above picture is going to be below the red line, and at least 50% of the extra money is “wasted”.

But really, it’s much worse than that. For one thing, this result basically assumes the worst case, where increasing prices doesn’t decrease demand at all. In the real world, demand will go down and the increase in wages will be even less.

For another, this doesn’t even account for waste! Suppose a price increase made wages go up 25%, but drivers now only spend 50% of their time actually driving people around. Are you happy? I’m not happy, because (1) this hurts riders and (2) it seems crazy to interfere with markets in ways that encourage people spend more time doing thing that aren’t productive.

(I’m sure that all the results in this section are known, but it was easier—and more fun—to just re-derive it myself.)

Discussion time

In practice, Massachusetts’ policy probably isn’t quite as bad as my simple model suggests: For one thing, in the real world, lower driver utilization will mean reduced wait times for riders, so the money isn’t totally wasted. And the minimum of $32.50/hr only seems to apply when averaged over a few weeks. And maybe some of the extra money will come out of the profits of the ride-sharing company? (Though one can argue that reducing profits is also bad.)

But still, if you want to run a command economy where the government sets prices, there are better ways of doing it! And this is not theoretical: New York mandates a minimum wage of $17.22/hr that includes time waiting around. The ridesharing companies responded to this as anyone could predict: They refuse to let drivers get on the clock at all. Jacobin bitterly calls this a “loophole”, but… what are we hoping for here? The money has to come from somewhere. Without a magical supply of extra riders, you can’t force prices above market rate without some kind of consequence!

Now, New York’s policy is kind of weird. It mandates a minimum wage, and then leaves it to companies to limit supply. The old-fashioned way of propping up driver pay is to limit taxi medallions, and then let the market price increase naturally. New York’s policy is very indirect, but amounts to basically the same thing.

(Incidentally, this isn’t just a story about ride-sharing. It’s also a decent model for why it’s bad that American realtors were able to establish a monopoly where they can extract 6% of the value of anyone who wants to sell a home. That doesn’t just take money away from home-selling and give it to real estate agents. It also subsidizes real-estate agents to spend lots of time competing with each other for clients in a way that does nothing to advance the welfare of general society.)

So really, I think Massachusetts’ policy is worse than bad—it’s a mistake. Riders pay more and get fewer rides. And for what? Basically to pay drivers to sit around, spending energy, wasting time, and increasing traffic. Healthy, ambitious societies do not do that.

Love the jab towards realtors at the end - pure deadweight loss. I'm amazed no technological solution has obsoleted them yet - even today YOU basically do all the work while they spam you with totally irrelevant houses / buyers, then they take 6%, it's monstrous.

This is a similar argument Uber made when everyone was demanding they add tipping. You can’t outsmart the market.

FWIW, drivers would much rather get paid to sit sit around than to drive (and less vehicle cost incurred), so they’d support the tradeoff explained in this post - although I suspect this will cause wages to fall below pre-minimum wage baseline since it’s a more pleasant job now.

I worked at a ride sharing company for years - the public’s lack of understanding of the relevant dynamics was an endless source of frustration.